There are many lessons one can learn about long-term investing: stocks don’t go up and down they go down and up; past performance is not indictive of future results; not all investors are rational; many stocks are overvalued, and many are undervalued. But of all the lessons, dollar-cost-averaging could be the most underrated. It is also somewhat counterintuitive; can volatility be a good thing? Could it matter whether I invest $12,000 once a year or $1,000 every month? Yes, and yes!

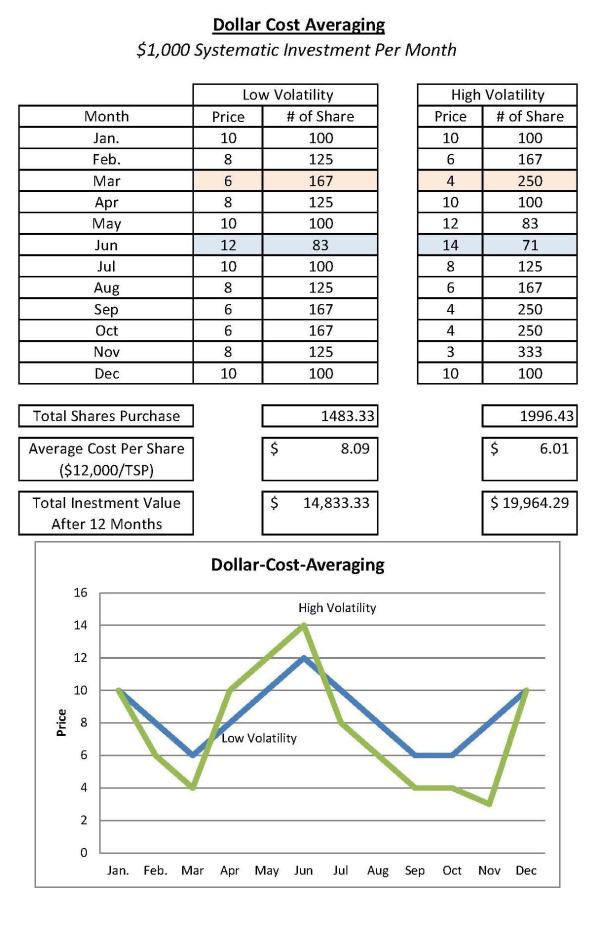

The graph and chart below show the same $1,000 monthly deposit into two different hypothetical investments. You can see that in January we purchased 100 shares of each investment because the share price was $10 for each. ($1,000/$10 = 100 shares). Notice that as the share price goes lower you purchase more shares with your $1,000 monthly investment and less shares as the price moves upwards.

At the end of our hypothetical year the price is right back where it started at $10. If you had invested $12,000 at the beginning, you would have $12,000 at the end. But because we were dollar-cost-averaging we acquired more shares than we would have otherwise. Now, to be sure, this technique works best with assets that appreciate over the long run. Having more shares in a bankrupt company does you no good. That is why dollar-cost-averaging is so productive with diversified investments.

The best part about this investing technique is that it requires no timing on the part of the investor. The 401(k) is where the most dollar-cost-averaging takes place. Every week or two an employee contributes a portion of his or her pay into the account on a regular basis. Because the time-horizon for a retirement account is usually long, it can make sense to take on riskier investments which are more appropriate for dollar-cost-averaging.

Systematic investment plans do not assure protection against loss in declining markets. Such plans involve continuous investment, regardless of market conditions. Markets will fluctuate, and clients must consider their ability to continue investing during periods of low price levels. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value.