Imagine being a high school student working on the weekends. And suppose you are self-employed as a lawn care specialist. You would naturally expect the larger the lawn, the more you would be compensated for your expertise in operating the mower. However, something strange has happened this summer: in the city, where the lawns are smaller, there has been a lot of rain and the smaller lawns have grown more quickly than the larger ones in rural areas. Suddenly, the half-acre lot you’ve been cutting needs to be cut more frequently than the two-acre lot, and the demand downtown has increased. This is of course a temporary dislocation in the market, but none-the-less you are now being paid more to cut smaller lawns than the larger ones.

We are witnessing a similar trend in the market for bonds, specifically United States Treasuries. When you buy a US Treasury you are making a loan to the federal government. In normal times you are paid more interest on these loans the longer you must wait to get your principal back. But that’s not what’s going on right now: now you are getting paid more to hold short maturity bonds. It has been pouring rain in the city.

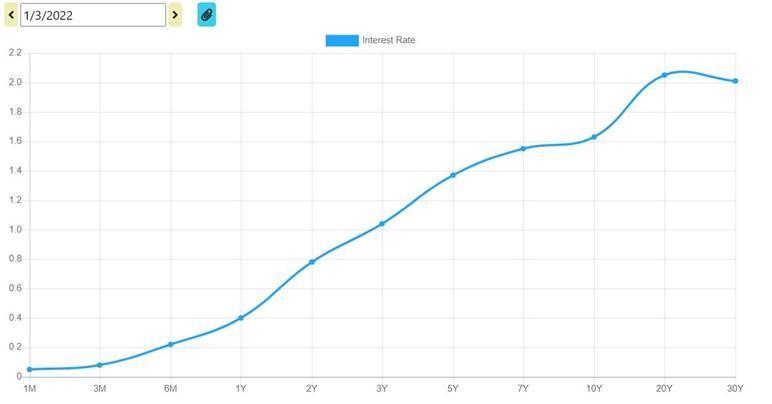

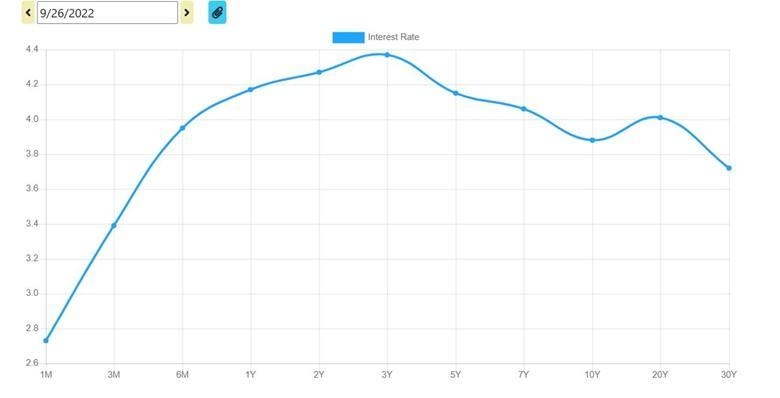

As I write this the one-year treasury bill is paying 4.17% and the 10-year treasury bond is paying 3.88%. This is what is known as an inverted yield curve. Below are two charts that show the so called “yield curve” at the beginning of this year and at the end of September. The values on the vertical axis show the interest rate and the horizontal axis shows the years until maturity. At the beginning of the year the slope of the curve was consistent, up and to the left. Today we have a steep upward sloping curve at the short end (one-month, 3-month, 6-month, 1-year) and a downward sloping curve at the long end (1-year through 10-year).

For the high school student who is cutting lawns in an exceptionally wet season in the city, the question of why it is raining so much is not particularly useful (the angels are crying?). But to bond investors it is much more obvious why the market looks the way that it does: it’s all about the path of future interest rates. When rates rise, old bond prices fall because new bonds pay a higher rate, and all things being equal any bond investor would prefer to have a higher interest rate. Therefore, bond prices fall when interest rates are rising; the faster they rise the faster prices fall. The current bear market for bonds is one of the worst on record.

As of right now the path of future rates looks to be “higher for longer” – those words came straight from the horse’s mouth, Fed Chair Jerome Powell. But investors have a bad habit of assuming trends continue for longer than they will. When things are bad, they will only get worse, when they’re good they will only get better. A wise man once told me that market participants think in straight lines, but the market itself moves in cycles.

So, what will break this cycle of rising rates? First, inflation needs to decrease significantly. The Fed has stated numerous times this year that they have an unconditional commitment to lowering inflation back to 2%. August’s year-over-year inflation report showed that prices in the economy increased at just over 8%. That 6% difference is much bigger than you might think. The first shoe to drop will be when the fed funds rate (currently at 3%) gets above the CPI reading. Once that happens the Fed will most likely stop raising interest rates and the bond market should stabilize, at which point bonds will pay a decent yield. Heck, they finally pay a decent yield now!

Just as the future path of interest rates will dictate bond prices, so too will the future path of corporate earnings for stock prices. 2021 was a monster year for S&P 500 earnings. All the COVID stimulus and money printing (which is causing huge problems now) was a boon to stocks last year. Everyone knew that earnings would have to come back to earth in 2022. The question is how far into the stratosphere did we get last year? The current bear market for stocks is, believe or not, rather ordinary. Since 1950 the average bear market has resulted in a 30% draw down, as of this writing the S&P 500 is down only 23%.

Stocks could take longer to bounce back than bonds. That’s because the path for bonds has already been largely traversed (interest rates have come up a lot). But corporate earnings could still have further to fall, especially if unemployment starts to increase. However, much of the decline in earnings is already priced in. Don’t forget that most participants think in straight lines and if/when earnings do start to fall more some will assume they will fall forever. And forever is a long time, especially towards the end.

All of this brings us back to the most important thing: the Unities States Dollar. Currencies are sort of an enigma to the average investor, as the only way to measure their value is relative to some other currency. You cannot measure it against itself like you would a stock. The dollar index (a measure of the US dollar against a basket of currencies, 60% of which is the Euro) is at a 20 year high. There are not many currencies in the world that have appreciated against the almighty dollar this year. I have two takeaways from this: 1) The US is still by far the most dominant player in the global economy. Any talk about the US losing influence around the world is sort of over blown in my opinion. Short term treasuries (aka the “risk free” asset) are now paying a halfway decent yield and they are in high demand. 2) Just over half of the revenues from S&P 500 companies are generated overseas. This means when those companies want to bring those profits back to the US they must participate in foreign exchange. Because the dollar has been screaming higher this year, those profits lose value. Combine that with inflation raising the cost of doing business and an “earnings recession” is likely for US large cap stocks.

While the short term is especially uncertain right now, it’s important to keep things in perspective. Over the last 5 years (including this year’s bear market) the S&P 500 is up almost 10% per year. There must be a cost for these great returns. Afterall, nothing is free. The cost for great returns in the market is volatility, anxiety, and fear. Disciplined investors are aware of this and don’t try to time the market. If you sell investments to avoid these costs, you are essentially trying to get something for nothing.