For most of modern economic history there have been basically three things you could invest your money in. In the future there may be more. (In fact, I would be surprised if there weren’t.) There may be many permutations and derivatives of these three but at the end of the day this is what you’ve got: Land, Commodities, and Businesses. Most people’s investment in land comes from the parcel they call their home, and you can invest in businesses by owning stocks and bonds. But commodities are rarely owned by investors.

For the last few decades, it’s easy to see why commodities have not gotten much attention. The Bloomberg Commodities Index which tracks a diversified basket of metals, agricultural goods and petrochemicals has had some scary long-term numbers. For the last 15 years it has averaged a -1% rate of return. However, 2021 was a great year for the index which finished the year up 21%.

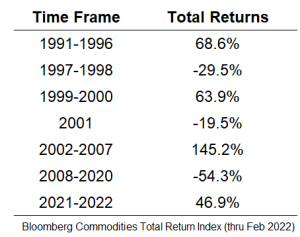

Commodities are a notoriously “boom and bust” asset class. Below are some examples. Credit to Ben Carlson (www.awealthofcommonsense.com) for the data. Getting the timing right on this space can be incredibly difficult.

Commodities are also fundamentally different from traditional asset classes such as stocks and bonds. For instance, stocks and bonds are typically valued by discounting expected future cash flows to arrive at a present value. Commodities, on the other hand, are valued based solely on supply and demand. As a result of these fundamental differences, commodities often have low or negative correlations with stocks and bonds.

One of the challenges to owning commodities in a diversified portfolio is the cost associated with developing the position. Aside from precious metals like gold and silver, you can’t actually own the raw materials themselves. Where would you like to store your oil? Who will feed your livestock? Because of this limitation most commodity strategies own futures contracts that attempt to track the price of these goods. Futures contracts are finite and must be renewed on a regular basis. There is a cost associated with this process.

If you are considering owning this funky asset class, please keep in mind that it is very volatile and knowing when to get in and out is incredibly difficult. A reasonable allocation of no more than 10% of your portfolio is also a must. I would also recommend owning a diversified portfolio of commodities. Not just one precious metal, oil, or agricultural product. When in doubt, speak with a professional investment manager who is a fiduciary.

*Investments in commodities may have greater volatility than investments in traditional securities. Specific commodities industries are affected by world events, government regulations, and economic and political risks. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or world events, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political, and regulatory developments. Use of leveraged commodity-linked derivatives creates an opportunity for increased return but, at the same time, creates the possibility for greater loss.