In November of 1999, when US growth stocks were approaching bubble territory, the US Federal Trade Commission approved – what was at the time – the largest corporate merger in American history. It was probably the most ironic merger in history as well; Exxon and Mobile were both part of the Standard Oil Trust which was dissolved almost 100 years earlier for violating antitrust laws.

At the time of their merger, Exxon was already the world’s largest energy company in the world and Mobile was the second largest oil and gas company in the US. By the time the 21st century began Exxon’s market cap was pushing $300 billion and was the second largest stock (behind General Electric) in the S&P 500. Towards the end of 2005 it would assume the top spot and start to pull away. On the eve of the Great Financial Crisis in 2008, Exxon had become far and away the largest stock in the index with a market cap of just over $400 billion, about twice as high as the second-place finisher that year.

Today Exxon’s market cap sits at $246 billion, has returned less than 2% per year the last decade for investors (including the dividend) and is the 25th largest stock in the market. The company is significantly smaller today, especially when you consider it was in the top 10 for multiple generations.

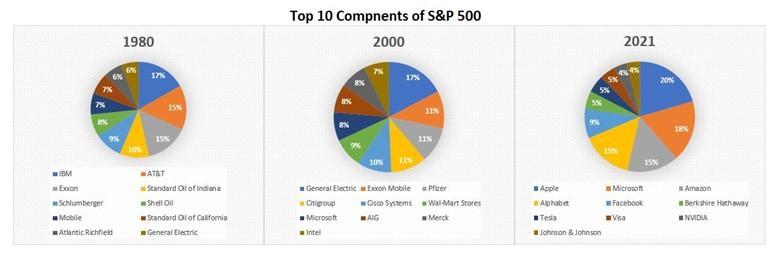

The pie graphs below show the top ten S&P 500 components in 1980, 2000 & today. Notice how in 1980 5 of the top 10 stocks were “Big Oil” companies. Even in 1990, energy represented 13.5% of the US stock market, virtual tied with industrials for the largest sector. Today energy accounts for 2% of the market while industrials take up 8.5%.

A few months ago, the Huffington Post ran an article titled “Is this a turning point for Big Oil?”. The piece was about recent events in the courts and in shareholder meetings that paint a not-so-rosy picture for the petrol giants as they continue to feel the pressure from society on climate change. Moreover, fuel efficiency continues to drive the price of energy down. A barrel of oil cost roughly the same today as it did 10 years ago. And don’t forget the dividends; the only appeal to these stocks is that they have a decent yield. After paying out the shareholders, these companies are running out of ways to retain their earnings. Make no mistake about it; Big Oil is not so big anymore – at least not as big as it once was.