A stock buyback, also known as a share repurchase, is a corporate action where a company buys back its own shares from the market. This process involves the company using its available funds to purchase outstanding shares, reducing the total number of shares outstanding. Stock buybacks can be executed for various reasons, such as returning excess cash to shareholders, boosting earnings per share (EPS), or signaling confidence in the company's future prospects. By reducing the number of shares in circulation, buybacks can potentially increase shareholder value due to the fundamental economic laws of supply and demand.

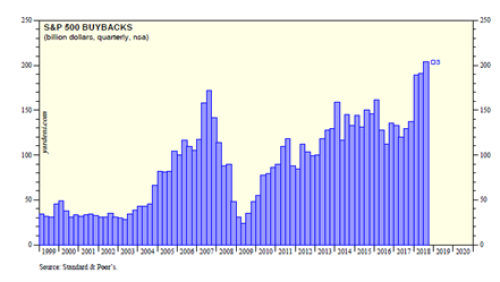

Stock buybacks were all but illegal for much of the 20th century. During that time, if a corporation wanted to return excess cash to shareholders, it issued a dividend. But during the 1980s, when deregulation was all the rave, the Securities and Exchange Commission began to relax those rules. Since then, more and more corporations have chosen the route of buybacks instead. The chart below (yardeni.com) shows the increase in this strategy since the turn of the 21st century. Except for a brief pause during the Great Financial Crisis, buybacks have been trending upwards.

Does it matter if a corporation issues a dividend or buys back its stock? It depends on where you are sitting. If you are the corporation, it doesn’t really matter; if you’re a shareholder, then it gets a little more interesting. A dividend paid out from a C-corporation is the only time in America where a dollar gets taxed twice. The corporation pays tax on its earnings and then the dividend is taxed to the shareholder. So, let’s say you are Jeff Bezos and are the largest shareholder of Amazon. Do you really need more taxable income on your personal tax return? Of course not, you’re one of the richest people in the world! You would much rather the corporation buy back stock (from people other than you), reduce the share count and make the shares more valuable. The tax on the capital gain is not owed until you sell the shares, and if you hold those shares until you die and pass them on to your heirs, they’ll receive a step up in basis and the tax essentially disappears.

How about from a different seat? Let’s view it from the angle of the IRS. Clearly if you are trying to maximize tax receipts, you’d want those retained earnings to be distributed as a dividend. And this is the main argument that politicians on the left make when railing against stock buybacks: it’s a great way for the super wealthy to avoid taxation.

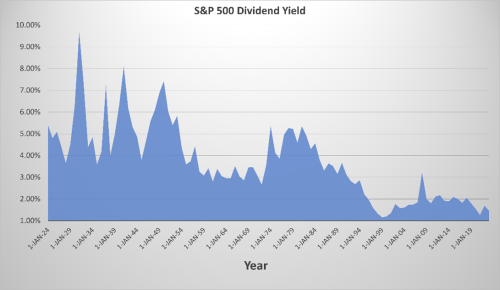

How about from the seat of the average investor? When a corporation continually buys back stock instead of paying a dividend, this means that you the investor must sell shares to produce income, which some may consider a drawback. However, if you are trying to stay diversified within your equity portfolio then you are going to have to give up some dividend yield as compared to a generation ago. (Dividend yield is calculated but dividing the dividend per share by the share price.) The chart below shows the average dividend yield for the S&P 500 for the last one hundred years. The decline is obvious.

If you were just focused on dividends over the last 20 years, you would have missed out on some of the most profitable companies the world has ever seen. Today the largest stocks in the world pay almost no dividend - but they buy back a lot of stock! In fact, the only sectors in the S&P 500 that currently pay a dividend yield above 3% (the long-term average for the market) are Energy, Utilities and Real Estate. Other than a good run recently for energy, those sectors have lagged the overall market on a total return basis (dividend + growth) significantly for the past decade.

Overall, for the average investor, diversification should be the most important strategy in a portfolio. This means playing the hand you are dealt and embracing stocks that are profitable regardless of how they decide to return value to shareholders.

*Diversification does not assure a profit or protect against loss in declining markets, and diversification cannot guarantee that any objective or goal will be achieved.